Many startups, entrepreneurs, inventors, innovators, SME founders and technology researchers around the globe have great business ideas, great business models and good business plans to change the world and create global success stories from their countries. However, their entrepreneurial local ecosystem may lack qualified angel investors or private equity funds to support them through investment, delivering quality mentoring and creating an international network.

These startups and entrepreneurs need to connect with global investment and entrepreneurial ecosystems to raise smart finance and to receive quality mentoring and valuable know-how. Many startups, entrepreneurs and SME founders do not have a sufficient level of English to communicate with global investors and business markets in their quest to raise finance and get much-needed mentoring.

As an affiliated partner of the G20 Global Partnership for Financial Inclusion (GPFI), the World Business Angels Investment Forum has developed a unique program—English for Fundraising, to support non-native English-speaking entrepreneurs and other players in entrepreneurship and investment ecosystems in their entrepreneurial journey and eventually contribute to the economic development of their country.

The English for Fundraising course will help ease access to smart finance from qualified investors and to quality mentoring. It will also contribute to increase the valuation of startup ventures and ease the due diligence and negation processes. Pitching business ideas to potential investors, raising finance from cross- border investors, dealing with global private equity funds, wealth management institutions, family offices and angel investors will be easier as well.

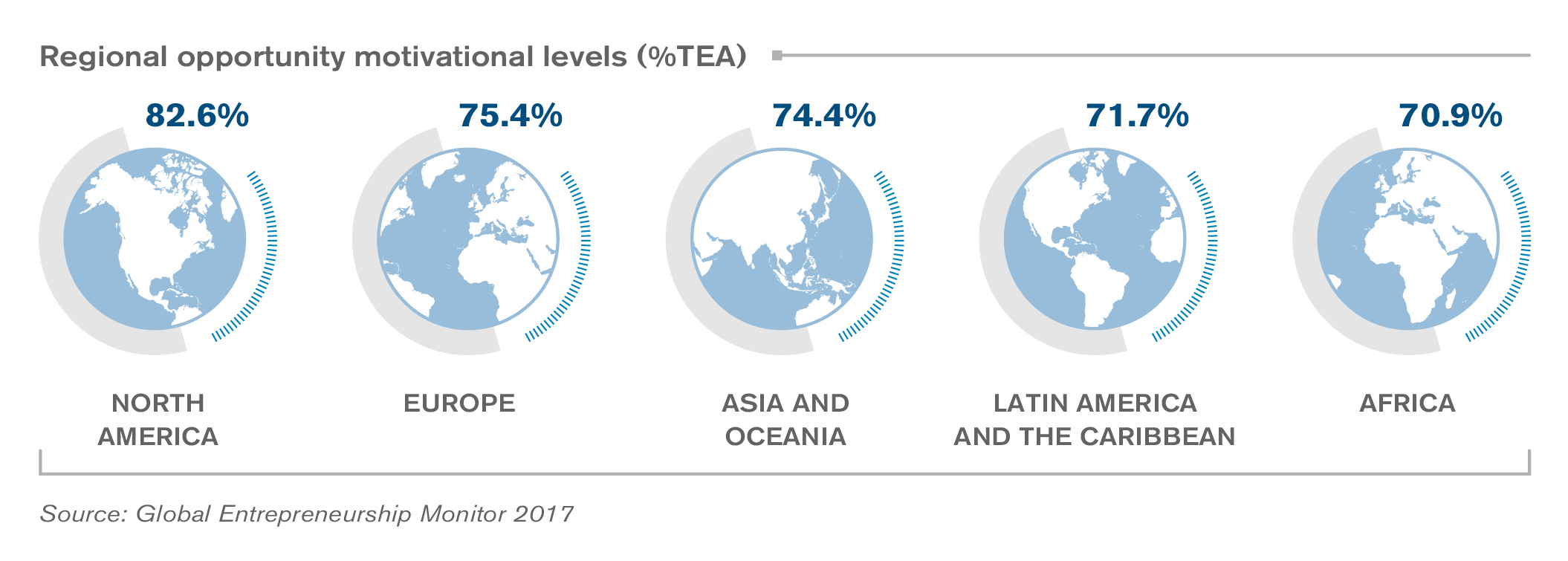

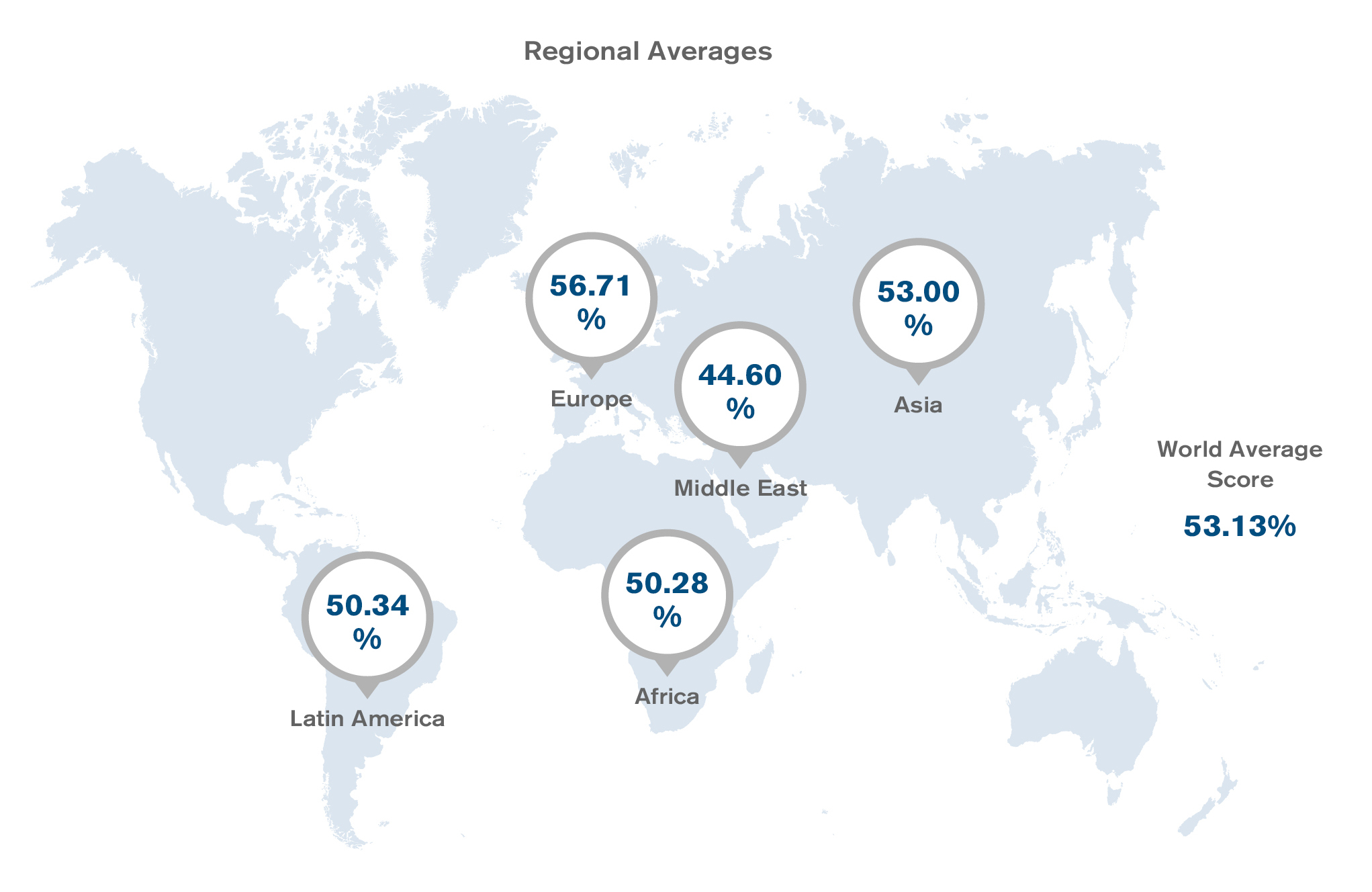

The global landscape of English language users

According to international reports, Europe has the highest English proficiency of any region by a wide margin as a result of decades of efforts by national ministries and the EU itself to promote multilingualism. There is still room for improvement in other parts of the world, however. For decades, Asia, for instance, has been the workshop of the world, fuelling economic development across the region. But a transition from manufacturing to knowledge-driven growth will require better English. Latin America, after years of stagnation, plans to improve English proficiency are gaining momentum. The Latin American business community is increasingly vocal in its demand for more English speakers. As for Africa, the past decade has seen a surge of foreign investment in infrastructure and business projects. Better English would strengthen these international collaborations. The continent is home to 21 of the world’s 30 fastest-growing urban areas. The Middle East, once at the forefront of science, literature, and trade, but today’s Middle East countries are today more marginal to cutting-edge research and economic production. Meeting challenges could have a transformative effect on the region, and improving the region’s relatively low English proficiency will play an essential part in the transition.

This course will serve to economies in increasing foreign direct investment to countries, attracting more global investors, connecting local entrepreneurs with global investors, promoting gender equality, and increase financial inclusion.

The ultimate goal of the programme is to produce qualified entrepreneurs and startups who can help empower world economies and who will be able to create global success stories. Globally connected entrepreneurs can thus have a great impact in terms of creating new jobs, new wealth and social justice.

Wishing you a great success!

WBAF Business School - World Business Angels Investment Forum

An affiliated partner of the G20 Global Partnership for Financial Inclusion (GPFI)

Individuals in the entrepreneurship ecosystem

Members of Public Institutions

And if you need English to …

The WBAF Business School offers a proficiency test for each of its certificate programmes. These are longitudinal, feedback-oriented educational assessment tools for the evaluation of the development and sustainability of cognitive knowledge in its certification programmes.

View All Programs

The WBAF Business School provides a hybrid learning experience in a multilingual and multi-cultural environment offering (a) online education (b) support from an individualized strategic advisory board, (c) stock exchange meetups and inter-continental study trips, (d) support from a corporate governance and SME support center and (e) proficiency-based qualification and certification.

Participants will first take the WBAF Entrepreneurship English Level Test (WEELT), which consists of an online multiple-choice test and an interview. They will be placed in ability groups in line with the test result. The fee for the WEELT is 95 EUR.

* Participants with WEELT 316 and above will take an oral exam. The recommended course for each participant will be determined after the oral exam. The exam will clarify if the participant should follow a course at his/her WELLT Level, above or below. (2) A0 – A1 – A2 will not take the oral exam. They are recommended to attend the English for Fundraising Course stated in the table above. (3) There are three modules in this speaking exam. In the first module, there are questions on general everyday topics. In the second part, there are debatable questions that should be answered in light of the personal opinions and reasons provided by the candidate. In the third module, the questions are all related to entrepreneurship and investment for starting up a new business. Due to the fact that the questions are all field-oriented in the third module, the answers given for the first two modules are taken into consideration in determining the language level of the applicant. Every candidate is allocated 15 minutes to complete the session, so each module lasts 5 minutes.

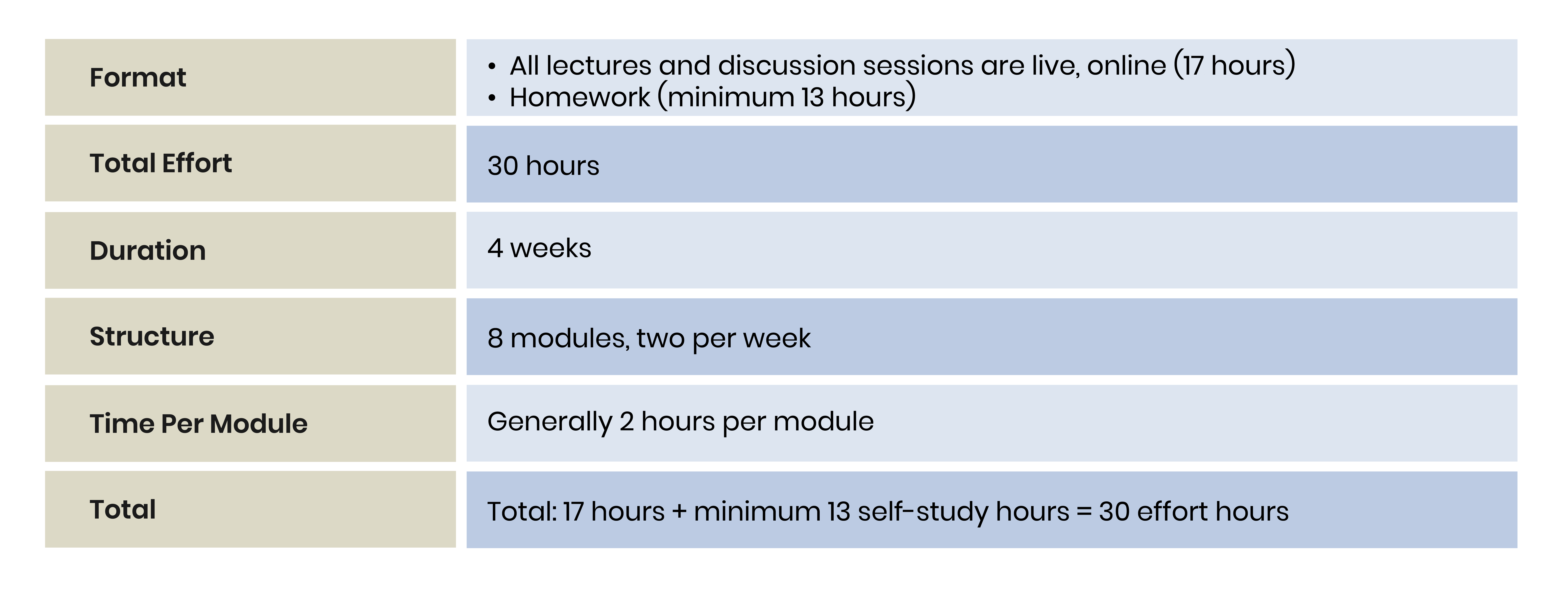

Total: 600 Class Hours (one class hour is 45 minutes)

Experts tell us that investors bet on the jockey, not the horse. Most of the due-diligence process is about getting to know the entrepreneur or the startup founder. This includes understanding their personal characteristics, and their communication skills, their background, and their level of engagement with local and international entrepreneurship ecosystems. Investors want to know who they are backing. Your skills and experience will make a difference.

There is a well-established view in angel investing that you must always back an A-grade team, even of everything else is B-grade. The reason is that an A-grade team is more likely to overcome challenges than B-grade teams, who may not be able to cope.

So, what makes an A-grade team? This module aims to help you develop a personal strategy so that you can position yourself as a ‘must-invest entrepreneur’.

The surest way to give others a clear idea about your communication skills, your behaviour as a team player, your self-confidence, your way of responding to unexpected situations and how you engage with your entrepreneurship ecosystem is to show videos of keynote speeches you have made and panels where you were either a moderator or a speaker. These will also serve as evidence that you are accepted as a thought leader in your field and have been invited to the stage to share your vision.

Participation in roundtables has benefits as well. Roundtables allow you to network with other expert speakers and the media. After you leave the stage, you will see that many participants will surround you trying to present their business cards to you if they are inspired by your vision. There is a huge difference between joining an international conference as a participant and as a speaker.

Another advantage on being on the stage is to discreetly mention your startup venture in your speeches.

This module will develop your speaking skills in English for participating in roundtables, open forums, panel discussions and delivering keynote speeches. These skills are also important in board meetings that you may attend with your investors after you have closed an investment deal.

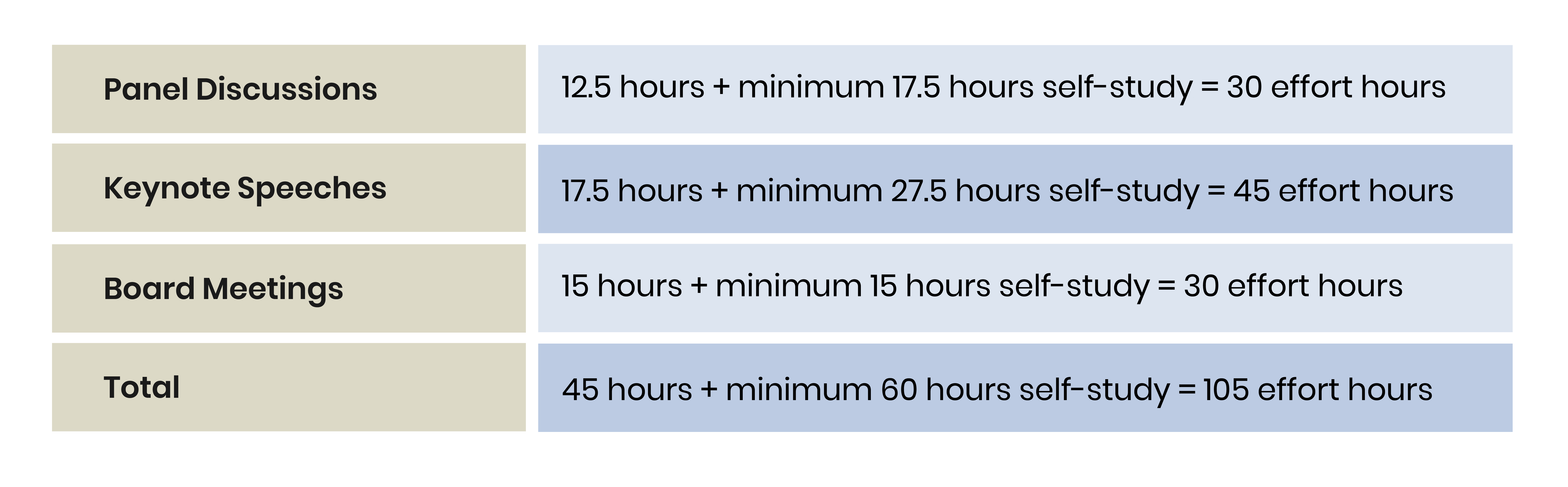

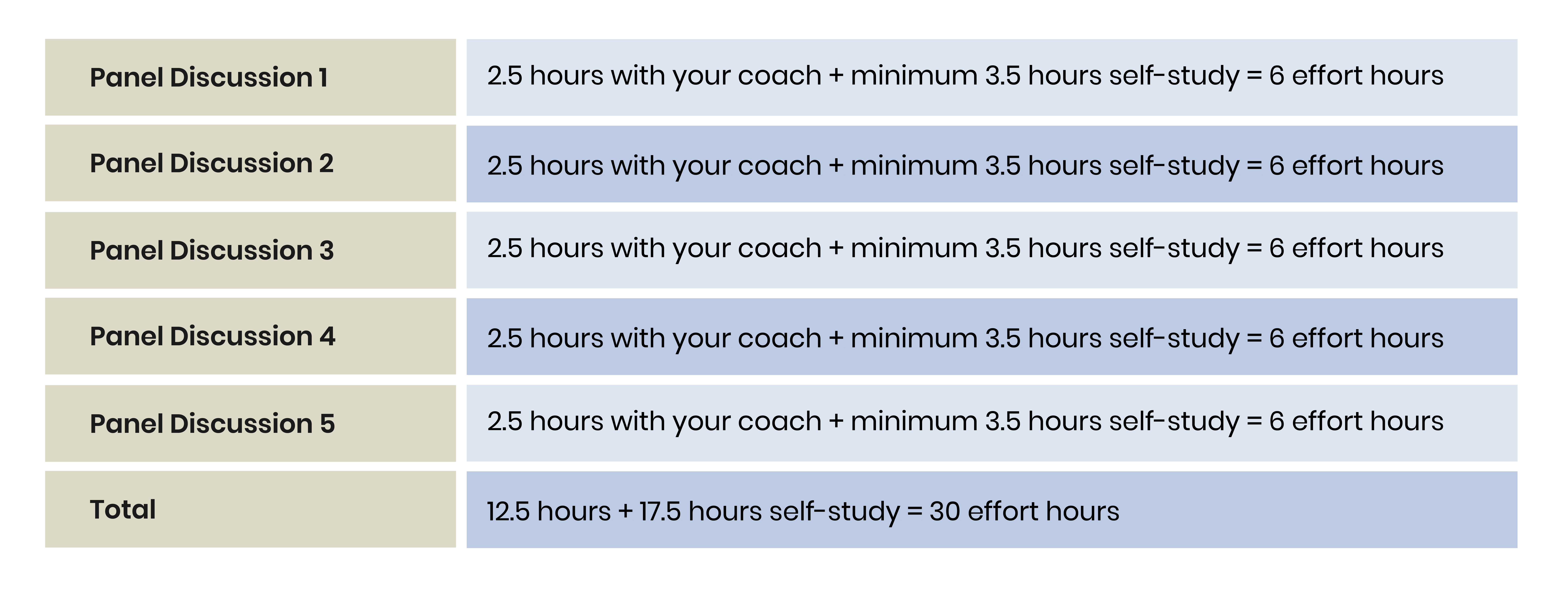

Panel Discussions

Joining roundtables and panel discussions in English as a speaker

Typical flow of a session:

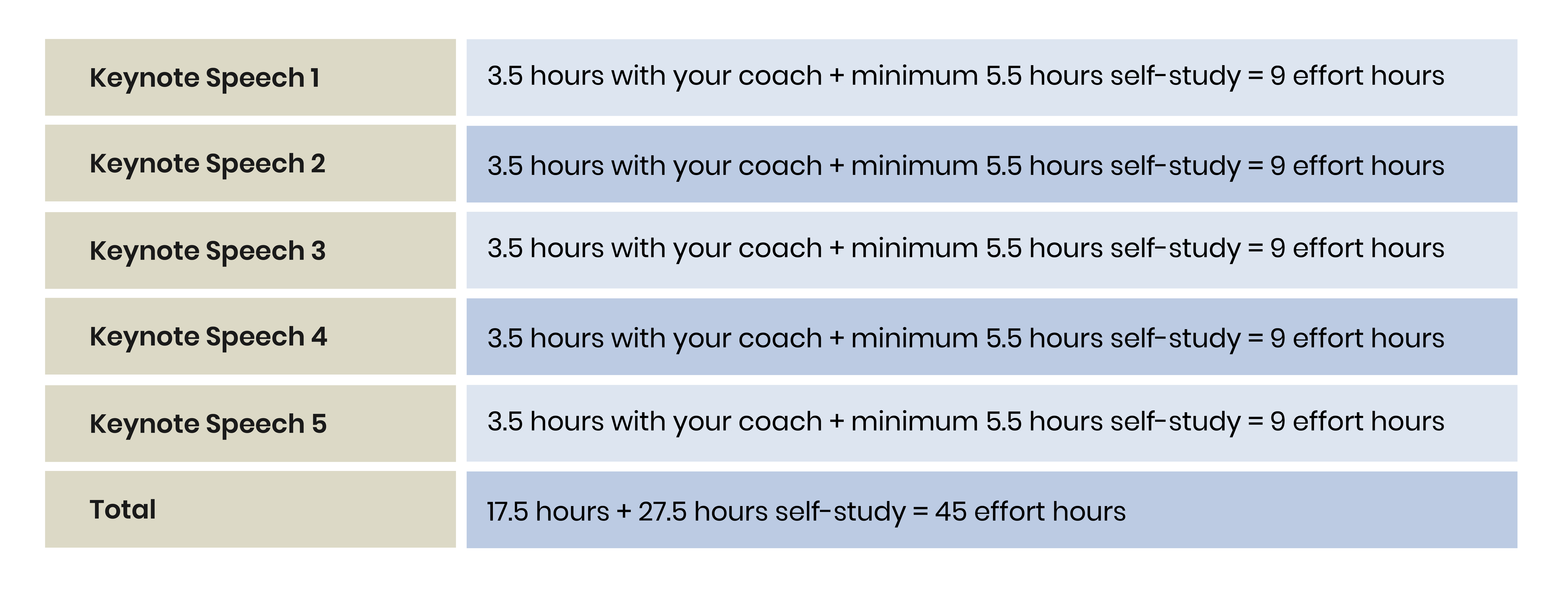

Keynote Speeches

Delivering keynote speeches in English

Typical flow of a session:

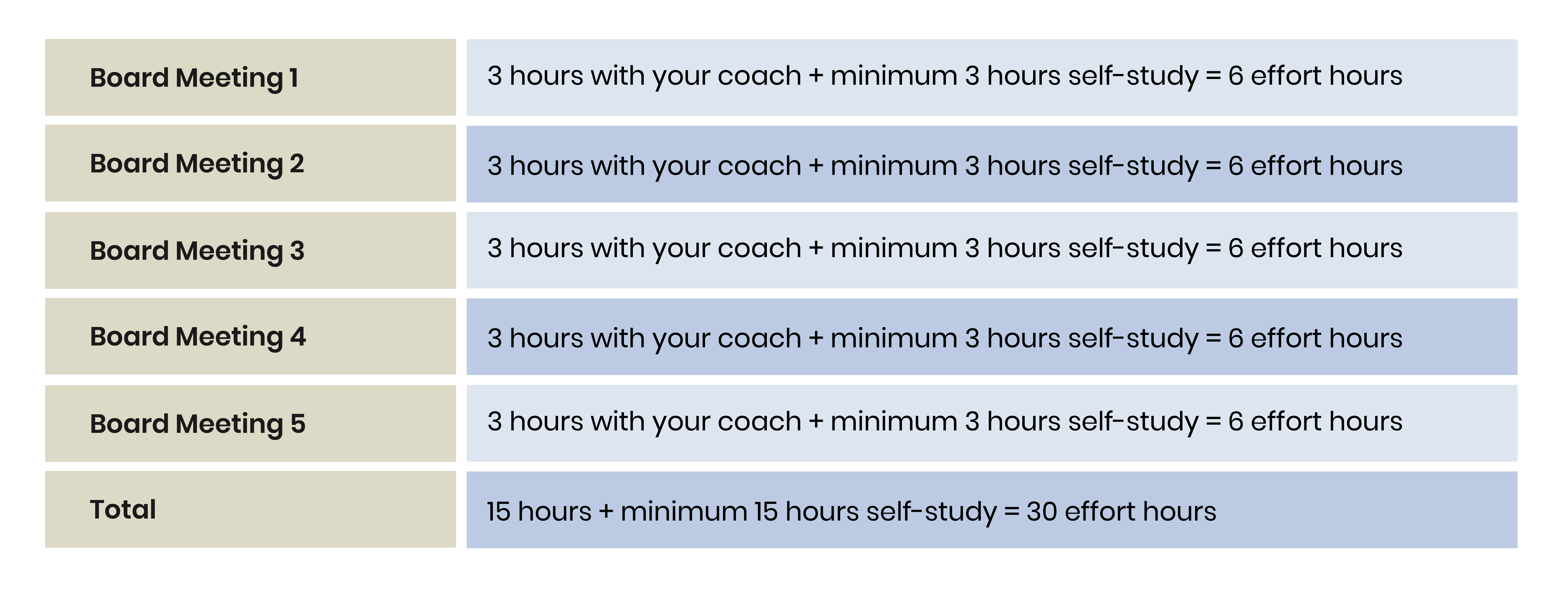

Board Meetings

Joining a board meeting with a defined agenda

Typical flow of a session:

A unique offering of the WBAF Business School is its individual strategic advisory boards (ISAB), each of which consists of a business mentor, a business consultant, and an executive coach. All participants in the School’s certificate programmes are eligible to apply for an ISAB. The ISABs are managed by the Corporate Governance and SME Support Centre of the WBAF Business School, which carefully selects the experts for each ISAB, taking into account the individual participant’s specific business and personal development needs. In order to assess individual needs, each participant is interviewed by a panel of 3 experts from various relevant fields and is given a Jung Typology test.

The aim of this module is to develop their reading, writing, listening and speaking skills to communicate with international mentors, coaches and consultants in English. Participants will find a great opportunity to think and write in English while they are preparing their questions for their mentors, coaches and consultants. They will develop listening and speaking skills during the mentoring, coaching and consulting sessions.

This module will also give the essential dynamics of mentoring, coaching and consulting sessions so that you know what to expect from each member of the ISAB (Individual Strategic Advisory Board).

Stage 1: Assessment

Stage 2: Establishing an ISAB for you

Corporate Governance and SME Support Centre will select the board members for your ISAB( Individual Strategic Advisory Board) and will appoint a Board President and 3 board members (mentor, coach and consultant)

Total: 3 Office hours

Stage 3: Introduction to ISAB

Total: 2 hours

Stage 4: Mentorship Sessions

Stage 5: Executive Coaching Sessions

Stage 6: Consulting Sessions

Total: 2 hours with your mentor + minimum 4 hours self-study = 6 effort hours

Fundraising may be one of the most difficult challenges that startups face, so it is important that they know how to find the right investors and the best way to approach them.

This course focuses on analysing and preparing your company and developing your pitching skills in a way that will enhance your chances of securing funding. One critical skill is the ability to understand the investor mindset. Then comes an analysis of your company in preparation for pitching to potential investors. The course will present frameworks that will help you build your business case and techniques that will hone your pitching skills. Examples and practical suggestions will help participants achieve their goal of raising funds.

Module 1: Introduction to the Global Startup Ecosystem

In this module, you will be guided through the world of startups and entrepreneurship. You will be introduced to the notions of startup, scaleup, angel investment, venture capital, crowdfunding, and accelerator. An overview of the funding process will be provided, followed by a discussion of the pros and cons of the various sources of funding.

Live Lesson: 75 min

Q&A: 30 min

Module 2: Understanding Business Models

In this module, you will learn how to use Alexander Osterwalder’s Business Model Canvas, a tool to help you approach business models in a straightforward, structured way. Using this canvas will provide insights about the customers you serve, what value propositions are offered through which channels, and how your company makes money.

Presentation by the lecturer: 90 min

Q&A: 30 min

Module 3: Understanding the Market

In this module, you will learn how to understand the market better. Getting to know your customers and competitors is an crucial step for all startups. Also from the investors’ point of view, the size of the market is a critical factor. Analysing the market and your competitors are critical factors that you need to consider in positioning your company and will be one of the main pillars for setting up your startup’s go-to-market strategy and branding and marketing activities.

Presentation by the lecturer: 60 min

Guest Speaker: 30 min

Q&A: 30 min

Module 4: The Problem–Solution Fit

In this module, you will learn the importance of paying attention to your customer’s problem and understanding whether your solution solves the problem. Osterwalder’s Value Proposition Canvas will be presented, followed by hands-on training. This module will help you define your customer’s profile, define their pains and problems and the gains they expect. Also define what are the pain killers and gain killers your company can deliver them. Also how to fit best solutions with the most important pains and problems.

Presentation by the lecturer: 75 min

Guest Speaker: 15 min

Q&A: 30 min

Module 5: The Product–Market Fit

In this module, we will cover topics related to product–market fit. You have to be able to recognize whether or not the product you offer solves a real problem and whether there is a large enough market for it. Without clarity on this, you could feasibly continue investing in building a product or service that is not commercially viable. In this module we will present the concept of a lean startup mindset and the importance of building an MVP to get fast feedback from potential customers.

Presentation by the lecturer: 75 min

Guest Speaker: 15 min

Q&A: 30 min

Module 6: Understanding Key Performance Indicators

This module focuses on key performance indicators (KPIs). KPIs act like control panels in a pilot’s cockpit. They provide important information on important business objectives and keep objectives at the forefront of decision-making. It is essential that business objectives be communicated across an organization. Ensuring that people know and are responsible for their own KPIs helps keep the business’s overarching goals top of mind.

Presentation by the lecturer: 90 min

Guest Speaker: 15 min

Q&A: 30 min

Module 7: Developing a Pitch

In this module, we will discuss important aspects that will affect the quality of your pitch. We will discuss your slide deck, delicate and important professional ethics issues, and business etiquette. We will go recommendations to help make your pitch appeals to both an investor’s heart and their brain.

Presentation by the lecturer: 90 min

Q&A: 30 min

Module 8: Live Pitching Session

Participants will pitch their venture to a group of experienced angel investors and accredited mentors, who will provide feedback on the business model and the pitch.

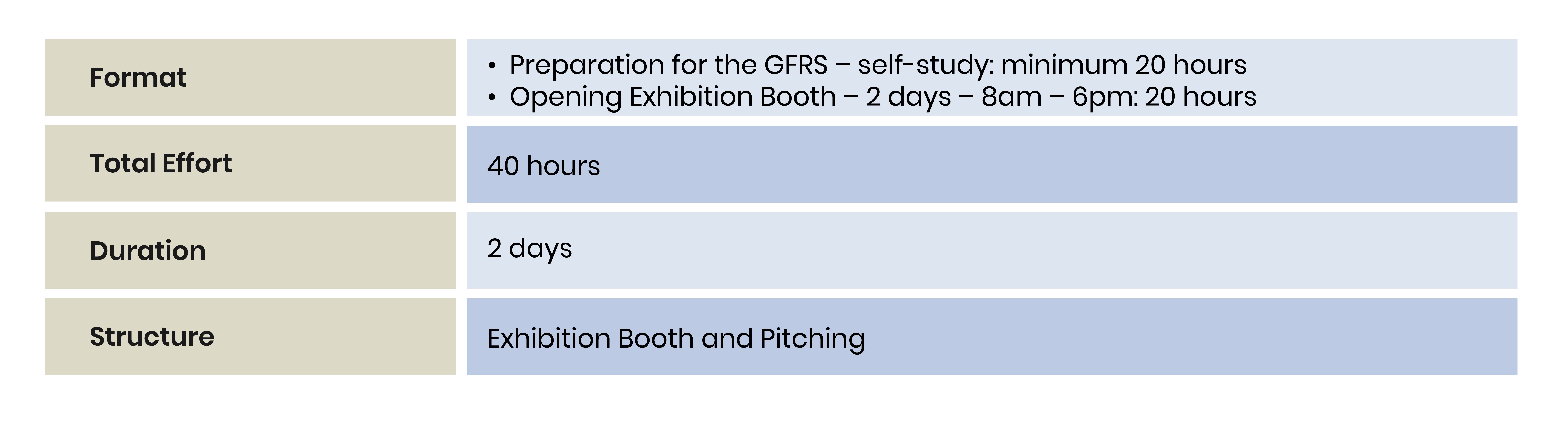

The Global Fundraising Stage (GFRS) is an international co-investment platform for investors, startups, scaleups and high-growth businesses which are aiming to globalise by raising funds from qualified investors.

The GFRS aims to create a high-quality portfolio with some of the world’s most promising startups, scaleups and, at the same time, create opportunities for co-investment and follow-on investments. The GFRS also connects top startups with the best angel investors, making it possible for the startups to benefit not only from the investment but also the know-how, mentoring and networks of qualified investors.

The GFRS is designed to capitalise on the worldwide growth in entrepreneurial activity and venture financing for startups and scaleups and to benefit from WBAF’s extensive network of global investors, which includes angel investors, private equity funds, co-investment platforms, wealth management institutions, family offices, VCs and acceleration centres.

The Global Fundraising Stage is supported by the WBAF Angel Investment Fund, which aims to invest in startups of the GFRS. It provides a unique opportunity to 100 selected startups and scaleups to pitch their businesses on WBAF’s Global Fundraising Stage at its World Congress on the third week of every February. [It is important to note that the WBAF Angel Investment Fund is only one of many investors and investing institutions that will be present at the GFRS.]

The mission is to showcase the world’s top startups and scaleups, which, typically, are funded companies in the process of raising €50K – €3M, with the aim of globalising.

Participants who complete the EFF Program with minimum WEELT 246 are eligible to pitch to investors on the Global Fundraising Stage. In the normal application process, startup founders apply to pitch on the GFRS between October and February. The ones who have scored as A-Level Startup or B-Level-Startup are eligible to open an exhibition booth at the World Congress of Angel Investors (which takes place over 2 days each February) and pitch on the GFRS.

EFF participants with minimum WEELT 316 can join the GFRS as an A-level startup without going through the standard application and scoring. They will be communicated directly with GFRS administration about their exhibition booth and their pitching slot on the Global Fundraising Stage.

Typical profile of those who pitch on the GFRS:

Schedule:

Participants will make a 3-minute to pitch to angel investors, private equity fund managers, corporate venture executives, family office executives, wealth management office executives, VCs, co-investment funds and WBAF Angel Investment Fund.

As an affiliated partner of the G20 Global Partnership for Financial Inclusion (GPFI), the World Business Angels Investment Forum aims to empower the world economy by connecting startup economies with the main players of the Foreign Direct Investment (FDI) ecosystem. The ultimate goal is to pave the way for world- class investments by engaging economic development boards, regional development agencies, investment promotion agencies, chambers of commerce and industry, business councils, government ministries, and economic development departments of municipalities, which will contribute to the creation of jobs, social justice and wealth for local economies.

WBAF holds that, with the participation of individuals in multiple sectors and from all parts of society, real progress can be achieved. One way WBAF encourages cooperation at both individual and institutional levels is to promote and support engagement with the global FDI ecosystem. The mechanism is WBAF’s Global Foreign Direct Investment Stage (GFDI), held annually at its World Congress.

The Global Foreign Direct Investment Stage (GFDI) is a global convergence of various entities ranging from economic development board leaders to investment promotion agency executives, all of whom come to share with global investors the unique opportunities in their respective countries. The GFDI is tasked with identifying emerging trends and furthering the Forum’s mission of easing access to finance for projects that have high potential for delivering a good return on investment.

The financing of emerging high-growth-potential businesses through angel investment and investments from VCs and CVCs are at record levels, despite negative global FDI trends.

WBAF believes that, by combining regular contributions from the numerous dynamic players of early and post-early stage equity and capital markets around the world, we all benefit from shared learning, better networks and increased exposure.

WBAF therefore invites all players of the FDI ecosystem to discover opportunities in equity and capital markets, the startup economy, and innovation ecosystems. WBAF encourages corporations and individuals to make cross-border investments and co-investments that will leverage the capacity of FDI and angel investments globally.

Participants who complete the EFF Program with minimum 70 points are eligible to pitch on the Global Foreign Direct Investment Stage. In normal application process, application process to the GFDI starts in October and end in February. The ones who are scored as A or B level FDI team win the right to open an exhibition booth at the World Congress of Angel Investors for 2 days and they pitch on GFDI which is on the second day of the Congress every February.

EFF Graduates with minimum 70 points can join the GFDI as A level participant without passing through the application and scoring pipeline. They will be communicated directly to GFDI administration and they will open their exhibition booth and pitch on the Global Foreign Direct Investment Stage.

Typical profile of GFDI Ecosystem:

Pitching on the Global Foreign Direct Investment Stage (GFDI): 10 minutes

Participants will make a 10-minute to pitch to private investors, corporate investors, angel investors, private equity fund managers, family office executives, wealth management office executives, VCs and co-investment funds.

The English for Fundraising (EFF) programme is a multi-disciplinary programme that has been designed to develop English language skills for entrepreneurial purposes, develop personal and business objectives of individuals who are engaged with entrepreneurial ecosystem, and to pave the way for pitching on either the Global Fundraising Stage (GFRS) or the Global Foreign Direct Investment Stage (GFDI). This engagement maybe in the form of a startup founders, directors of technology transfer offices, investors, innovators, private equity fund executives or public executives.

All modules are designed in a way that allows participants to achieve two goals at the same time: While developing personal and business skills to raise funds for their startup venture or investment project, they have the opportunity to use English simulations of real-business-life situations such as roundtables, panel discussions, board meetings, mentoring sessions, executive coaching sessions, consulting sessions and pitching on the Global Fundraising Stage or FDI Stage.

The programme is staffed by faculty members from different departments of the WBAF Business School, Corporate Governance and SME Support Centre and the GFRS/GFDI Administration.

The WBAF Business School offers a framework that accommodates both synchronous and asynchronous learning. In order to support student’s progress, faculty members hold office hours for participants in asynchronous learning. The office hours are live one-on-one online sessions with the lecturer to discuss any topic that is related to their module; mini-groups are also possible. Office hours for asynchronous learning courses are generally 1 hour per month. Office hour schedules will be announced after the participant registers for the course.

The programme concludes with a proficiency test and participants are awarded a professional certificate featuring your proficiency level and a personal WBAF Identity Card. The WBAF Business School awards two kinds of certificates: (a) a professional certificate is issued for successful completion of a programme that concludes with a proficiency test, and (b) a certificate of completion is issued for a course without a proficiency test.